What Is Stripe Payment? Methods, Safety, And Fees Explained

Payment gateway for businesses and individuals

Payment gateway for businesses and individuals

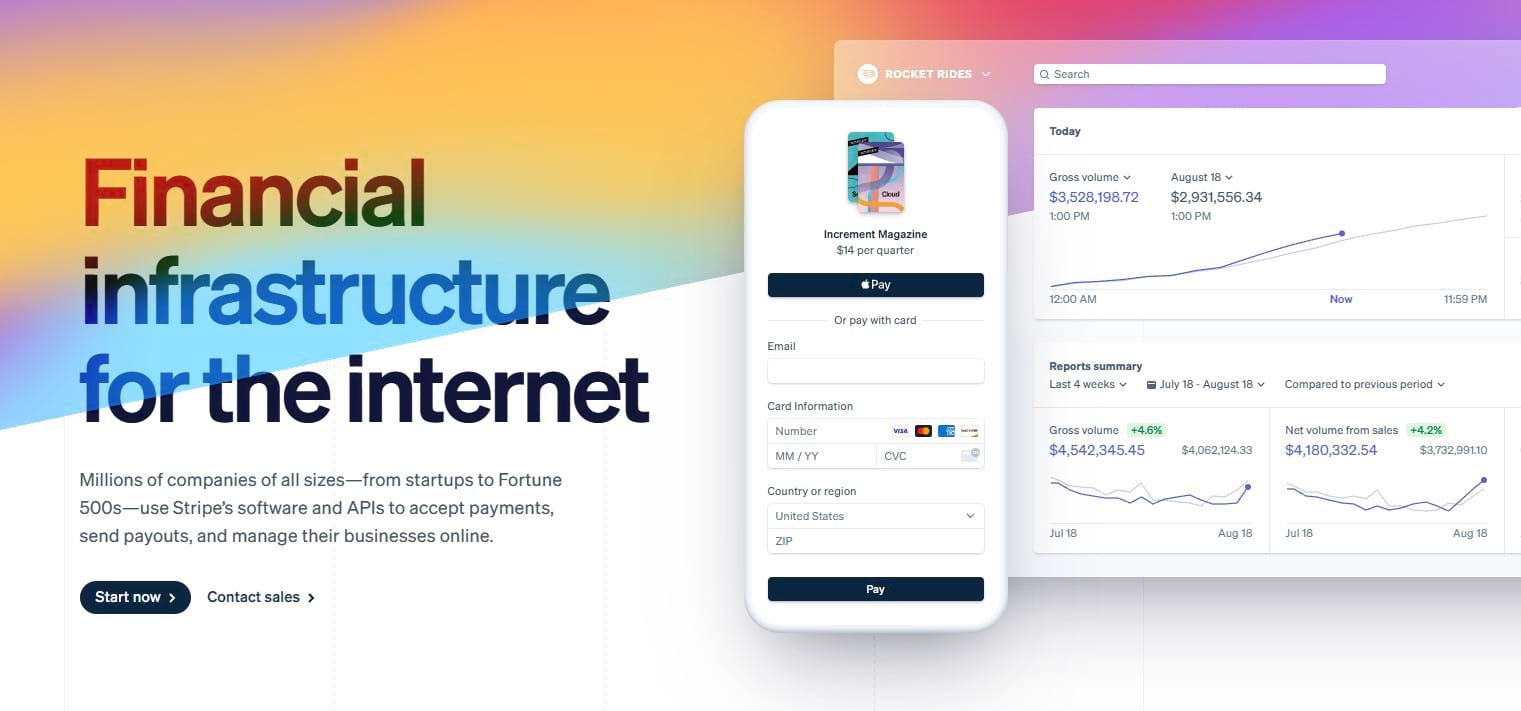

Stripe represents the escalating popularity of online payments for businesses and individuals, especially in the context of simplified international transactions. But what is Stripe payment? Do you genuinely possess a comprehension of this service?

In this article, we'll delve into the essence of this online payment processing platform. From its payment methods to its safety, and fee, scroll down and uncover the secrets!

Understanding Stripe payment: An in-depth overview

Stripe serves as a payment processing platform, facilitating global online businesses in accepting and handling customer payments. The inception of Stripe in 2010 was initiated by siblings Patrick and John Collison with the vision of simplifying and broadening online payment accessibility. With a broad spectrum of supported payment methods, currencies, and nations, Stripe equips diverse tools and functionalities for applications like subscriptions, invoicing, marketplaces, and in-person payments.

Thus, how does Stripe payment work? Stripe processes payments in six steps.

- The customer provides their card information, either online or in person.

- Those card details enter Stripe’s payment gateway, which encrypts the data.

- Stripe sends that data to the acquirer, which is a bank that will process the transaction on the merchant’s behalf.

- The payment will be processed through a card network to the customer’s issuing bank.

- The issuing bank approves or declines the requested transaction.

- Stripe notifies the merchant and the customer of the outcome.

These six easy steps make Stripe accessible to many people as the most convenient payment method. Nonetheless, to gain a more profound comprehension of Stripe, the limited overview lines provided above may not convey the breadth of this payment service. For a more comprehensive understanding, we invite you to peruse the article titled "What is Stripe?" available for your reference.

Getting to know the Stripe payment method

So “What is Stripe payment method? Stripe offers tools and features for different use cases, such as subscriptions, invoicing, marketplaces, and in-person payments. In this section, we’ll provide information about the Stripe account and highlight some of the features and advantages of using Stripe as a payment method for businesses and individuals. For more information on how to use Stripe, you can check out our article that we’ve written about it!

Features

- Security: Stripe employs advanced encryption and security protocols to protect your data and transactions. It complies with the Payment Card Industry Data Security Standard (PCI DSS) and has been audited by an independent PCI Qualified Security Assessor (QSA). Stripe also offers fraud prevention tools like 3D Secure and Radar.

- Flexibility: Numerous payment methods are supported by Stripe, including credit cards, debit cards, digital wallets (like Apple Pay or Google Pay), bank transfers (such as ACH or SEPA), and cryptocurrencies (like Bitcoin or Ethereum). You can also accept payments in multiple currencies and automatically convert them to your preferred currency at competitive rates.

- Scalability: Stripe can handle any transaction volume with reliability. It has a global presence in many countries and processes billions of dollars annually for millions of businesses. Stripe's APIs also allow you to create custom solutions for unique scenarios.

- Simplicity: Stripe's pricing is straightforward, charging a flat fee per successful transaction. There are no setup fees, monthly fees, hidden fees, or minimum charges. You only pay for what you use. Getting started with Stripe is quick and easy with minimal coding required.

How to create a Stripe account?

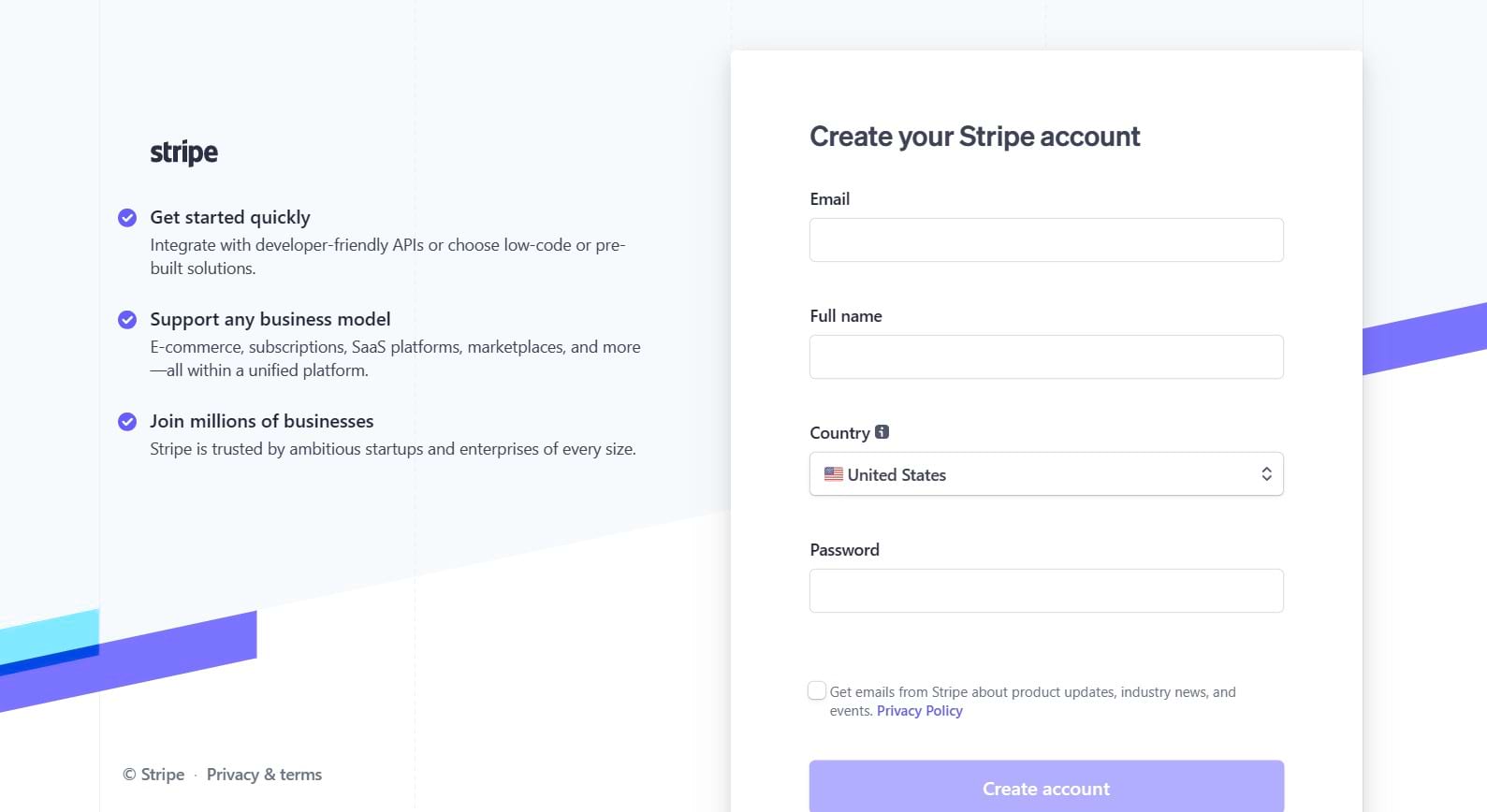

Stripe provides a user-friendly interface that makes it easy to create an account. Below are six simple steps to register:

- Step 1: Begin by navigating to the Stripe website and clicking on the "Start now" button.

- Step 2: Provide your email address, full name, chosen password, and indicate your country. Accept the terms of service and privacy policy, then proceed by clicking "Create account."

- Step 3: Verify your email address by clicking on the link sent to your provided email.

The friendly user interface on Stripe's account registration page

The friendly user interface on Stripe's account registration page

- Step 4: Complete the activation of your account by furnishing essential business details. This includes information like your business name, physical address, contact number, website URL, industry, and estimated revenue.

- Step 5: Incorporate a bank account where you wish to receive your Stripe payouts. You'll be prompted to provide your bank's name, account number, routing number, and the account holder's name.

- Step 6: Finalize the account activation by selecting the "Activate account" option.

With these steps accomplished, your Stripe account is now primed to serve as a reliable payment method for your online enterprise. Seamlessly integrate Stripe into your website or application using the integration alternatives offered by Stripe. Moreover, take the opportunity to navigate the dashboard and tailor settings to align with your individual preferences.

Unpacking the cost: Is Stripe payment method free?

Many options for businesses of all sizes

Many options for businesses of all sizes

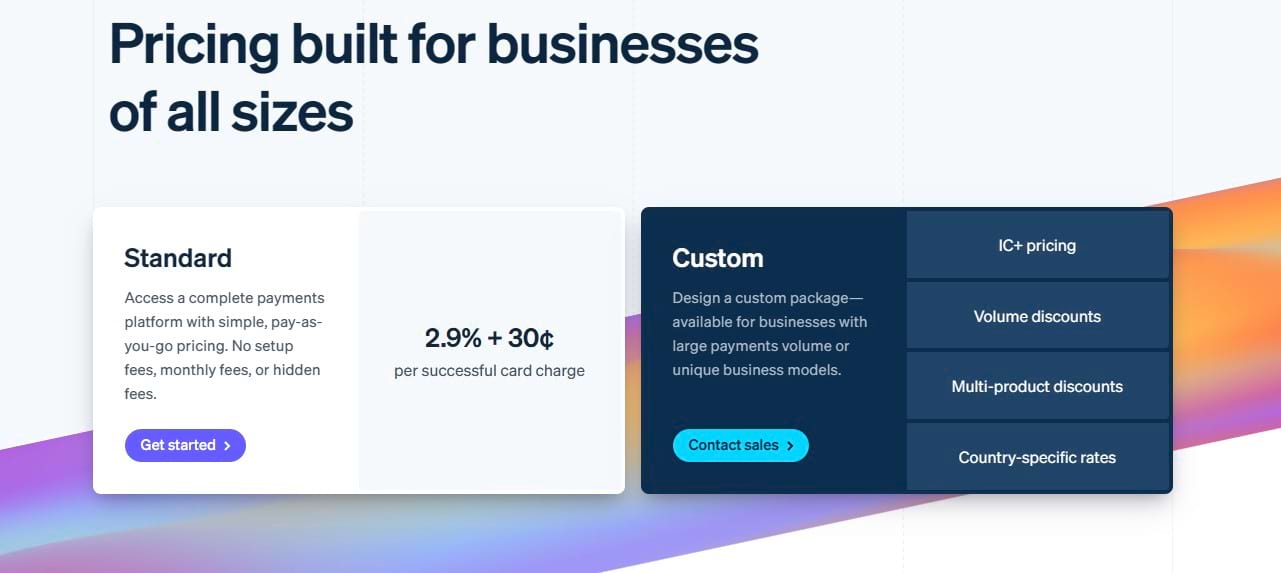

Many questions are burning, such as 'Does Stripe charge a fee?' or 'Is Stripe free?'

The answers to these inquiries are contingent on specific factors. Stripe refrains from imposing setup fees, monthly charges, concealed costs, or minimum fees upon its users. Instead, the pricing structure is devised around a pay-as-you-go model, wherein you incur charges for the services you actively utilize. It is pertinent to note, however, that Stripe does levy a standard fee for each successful transaction. The quantum of this fee varies, contingent on variables such as the chosen payment method, currency, and the nation where the transaction occurs.

As you can see, there is no definitive answer to these questions. It depends on how you use it and what you need from it. You should consider your business's needs and goals before choosing a payment method that suits you best. Nevertheless, you can use Stripe discount codes, which can help you save more on certain transactions or subscriptions. These codes can easily be found on coupon websites like Tenere. Let’s explore!

[exclusive_coupon|limit=3]

Stripe vs. Paypal

When considering the cost comparison between Stripe and other payment methods, nuances come into play. Factors such as your business model, transaction volume, customer preferences, and integration choices exert influence on this evaluation.

The rivalry between two brand

The rivalry between two brand

In the context of the United States, Stripe employs a fee structure of 2.9% along with 30 cents for each credit card or digital wallet transaction. In the case of bank debit transactions, the fee is set at 0.8% coupled with $5. To accurately discern the precise fee framework tailored to your specific geographical location, it becomes imperative to consult the Stripe website.

Drawing a parallel, PayPal enters the fray with its own fee configuration. For online transactions in the United States, PayPal levies a charge of 2.9% accompanied by 30 cents, akin to Stripe's fee structure for credit card or digital wallet transactions. Likewise, when delving into debit transactions, the fees mirror those of Stripe.

Nonetheless, PayPal also extends discount codes and promotions to customers, aiming to facilitate an optimal service experience at a cost-effective rate. You can explore their ongoing offers by visiting the PayPal coupon.

In summation, while assessing the comparative cost dynamics of Stripe against alternative payment methodologies, your business's distinctive attributes and the intricate interplay of transaction elements necessitate thorough consideration.

Safety matters: Is Stripe payment safe to use?

When it comes to online payments, security and safety are paramount. Ensuring your personal and financial information protected from hackers, fraudsters, and identity thieves is crucial. You also want your transactions to be processed smoothly and reliably without errors or delays. So, is Stripe payment safe?

PCI DSS, 3D Secure, and Radar are standards that contribute to Stripe's payment safety measures

PCI DSS, 3D Secure, and Radar are standards that contribute to Stripe's payment safety measures

As mentioned in the "Features" section above, Stripe adheres to the Payment Card Industry Data Security Standard (PCI DSS), a set of rules governing how cardholder data is handled. Stripe's compliance has been verified by an independent PCI Qualified Security Assessor (QSA), earning them the highest level of PCI certification: PCI Service Provider Level 1. This certification confirms Stripe's adherence to strict security requirements for card data handling.

Stripe also offers fraud prevention tools like 3D Secure and Radar. 3D Secure enhances online card payment security by requiring customers to verify their identity with their card issuer before completing a transaction. Radar, a machine learning system, assesses payment data to identify and stop fraudulent activity. It also allows you to customize fraud rules and settings according to your business needs.

User experiences and reviews: Insights from Stripe payment users

Stripe takes pride in supporting numerous payment methods, currencies, and countries while offering versatile tools for various needs like subscriptions, invoicing, marketplaces, and in-person payments. But what do Stripe's actual users think? How has it boosted their businesses and customer satisfaction? Let's delve into user feedback.

Stripe has achieved a rating of 9.6 out of 10 for their services

Stripe has achieved a rating of 9.6 out of 10 for their services

Numerous contented users have lauded Stripe for its remarkable ease of use, unwavering commitment to security, and exceptional customer support.

- "Stripe is the best payment gateway I have ever used. It is simple to integrate with my website and app, and it has a lot of features that make my life easier. That is excellent security and fraud prevention, and their customer service is always helpful and responsive." - Andy, Trustpilot user.

- “I have been using Stripe for a few years now, the website interface is easy to use, its system never had a glitch or error. Payments are smoothly deposited every time. I love using Stripe's services. Options like instant transfer help me get funds in my account sooner. Also, I am able to send a hosted and branded invoice to my customers, which is an amazing feature.” - Anna, US-Reviews user.

- “Personally I've had absolutely stellar experiences using Stripe as a payment platform for e-commerce. The dashboard is clean and intuitive, fees are low and the ability to get instant payouts after receiving a certain amount of funds is a huge bonus. I'd recommend it to anyone and everyone - especially against the awful competitors in this industry.” - Trustpilot user.

Nonetheless, Stripe has garnered negative feedback from users citing concerns over its fees, policies, and technical glitches.

- "They charge a lot of fees for every transaction, and they have hidden charges that they don't tell you upfront." - Mary.

- "Stripe has a lot of rules and regulations that make it hard to run a business. They also have a lot of bugs and glitches that cause problems with payments and refunds." - Tom.

As evident, Stripe garners both favorable and unfavorable user experiences and reviews. It's essential to carefully consider the pros and cons of using Stripe before determining its suitability for your business.

Conclusion

To sum up our article on What is Stripe Payment? We saw Stripe Payment shows itself as a robust and versatile platform that has revolutionized online transactions. Stripe offers versatile features aligned with industry standards like PCI DSS, with costs being transparent and tied to a pay-as-you-go model, ensuring users pay only for their actual usage.

Embracing diverse payment methods and currencies, Stripe empowers businesses worldwide. So are you waiting for what? Visit their website now!