How To Use Stripe To Scale Your Business Globally And Optimize Your Performance

To achieve international business growth, a robust online payment solution like Stripe is indispensable. Learn how to use Stripe in this article to enhance operational efficiency and reach a global customer base effectively.

[table_content]

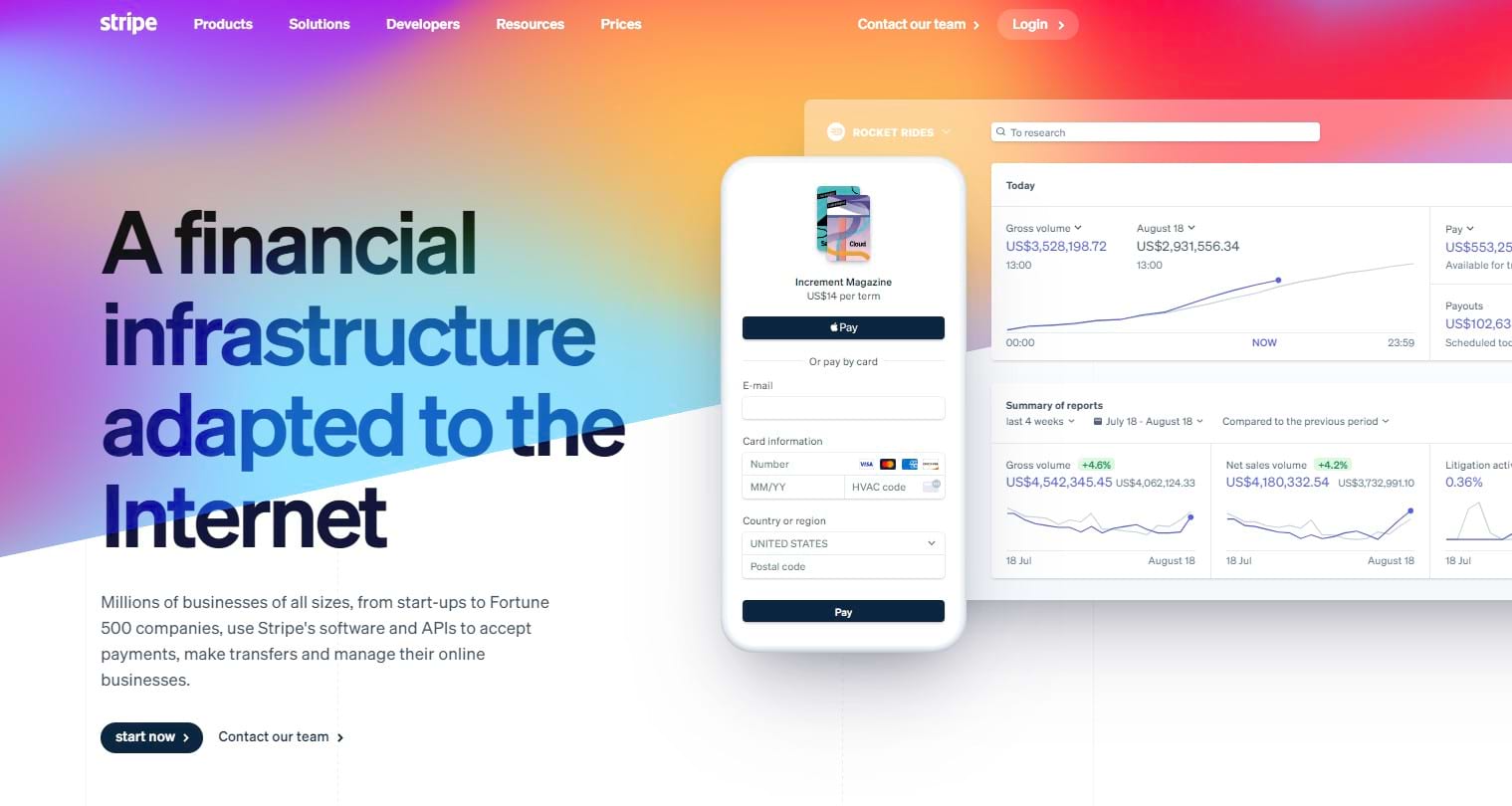

About Stripe

What is Stripe? This is a solution tailored for businesses spanning all scales and is a facilitator for payment acceptance, billing management, secure payouts, anti-fraud measures, and global expansion.

Stripe

Stripe was born with the initiation of a personal desire to establish an online venture. Among the complicated, costly, and unreliable payment solutions, Stripe promises to deliver easy, economical, and secure payment to businesses. Serving as a versatile intermediary, Stripe performs on its user’s behalf. They can transfer money in over 135 currencies, using credit cards, debit cards, Apple Pay, Google Pay or cash. The transaction is entirely secured with APIs, and SDKs, increasing customer trust.

This online payment processing platform boasts a global clientele, proving its flexibility to cope with enterprises of all sizes, from startups to corporations of e-commerce, software, marketplaces, platforms, and nonprofits. Stripe's partners are Amazon, Shopify, Spotify, Uber, Zoom, and UNICEF.

Beyond its utilitarian function, Stripe developed into a community of visionary entrepreneurs unified by its drive to foster and nurture online businesses through impeccable payment solutions.

Navigating the basics: How to use Stripe for payments

What is Stripe payment and how to use it to receive money from your customers? Follow our step-by-step instructions and start to have a complete experience, from registering to receive payments.

Registering

To start becoming a member of Stripe, follow these steps:

- Visit the Stripe website and choose your country and language. For example, if you are in France, you can go to Stripe France.

- Find the "Login" button on the top right corner of the page. During this process, you will have to enter an email address and create a password for your Stripe account.

- After this step, you will be redirected to the Stripe dashboard, where you can access various features and settings for your account. The platform will also send a notification: "Activate your account to receive payments".

- Click on the "Activate your account" button and fill out the account application form. Stripe will require some basic information about your business, your product, and your personal relationship with your business. By doing so, they can prevent abuse of the financial system.

- Once the account application is completed, you will be able to accept live payments from your customers. The business information and statement descriptor can be updated later at any time.

Payments

After integrating Stripe, what payment methods are available? By becoming familiar with the methods from this platform, your operation of receiving money would be simpler.

Stripe payment methods

The payment methods of Stripe include:

- Cards: If you are a user of Visa, Mastercard, American Express, Discover, JCB, Diners Club, China UnionPay and debit cards, then Stripe could be an ideal platform.

- Wallets: Mobile wallets (Apple Pay, Google Pay, Alipay, WeChat Pay) can receive money from Stripe.

- Bank debits and transfers: Stripe accepts payments from bank debit systems of ACH, SEPA Direct Debit, Bacs Direct Debit, BECS Direct Debit, FPX, iDEAL, and so on.

- Bank redirects: Bank redirect systems like Sofort, Giropay, EPS, and Przelewy24 are acceptable at Stripe.

- Buy now, pay later: This platform also allows users of pay later services such as Afterpay, Klarna, and Affirm to accept payments.

- Cash-based vouchers: Transactions using cash-based vouchers, for instance, OXXO and Multibanco are usable.

Ensuring security: How to keep your transactions safe with Stripe

Stripe carries out 4 security measures to ensure that its services are safe and reliable, which reinforces trust from customers.

First of all, Stripes is certified as a PCI Level 1 Service Provider, meaning they follow the PCI DSS (Payment Card Industry Data Security Standards), owning the highest level of certification in the payment industry.

Secondly, Stripe encrypts all card numbers and sensitive data at rest with the strong encryption algorithm, shown by the AES-256. This system also uses HTTPS and HSTS to ensure secure connections between its website, API, and users.

Stripe tokenization to replace card numbers and other sensitive data with random strings of characters, called tokens. The tokens are only available when a payment happens on Stripe and cannot be used by anyone else.

Last but not least, Stripe regularly conducts penetration testing, which is a process of simulating attacks on its systems and networks to identify and fix any vulnerabilities or weaknesses. Their third-party "bug bounty" program contributes to reporting any bugs or flaws in Stripe's security system.

Tips and tricks: Making the most of Stripe's features

What will users get when using Stripe? With its features, it can make your transaction process easier than ever. The features include:

- Comprehensive solution: Online payments, recurring payments, platform and marketplace payments, revenue optimization, and so on.

- Powerful tools: APIs, SDKs, webhooks, plugins, and libraries.

- Rich documentation: A set of documentation of dashboard basics and Stripe API reference, helping developers integrate Stripe into their applications.

- Pre-built solutions: Checkout, Payment Links, and Elements, allowing business owners to create and customize their own payment pages without coding.

- Security: With its employment PCI-compliant and use of machine learning to detect and prevent fraud, Stripe successfully protects customers’ data safely. The company also supports 3D Secure 2 authentication and dynamic card updates.

- Flexibility: Stripe is available for businesses in 43 countries and supports more than 135 currencies. They handle currency conversion, tax calculation, and subsidiary support for global businesses.

How to delete your Stripe account

If there are any reasons that you no longer need this service, then this is the instruction on how to delete Stripe accounts. Follow these steps to erase your account:

- You should assess and prepare your account by evaluating your reasons for the deletion and make sure there are no pending or failed transactions, subscriptions, or invoices that need to be resolved. Your customers and stakeholders should be notified in advance.

- Export data from your Stripe dashboard, such as customer information, transaction history, reports, etc.

- After completing the previous steps, log in to your Stripe account and move to the account settings. There will be an option to disable your account, which includes steps of verifying your identity or settling any outstanding fees. Finish filling in and choose to disable and start deleting.

- Once your Stripe account is deleted, you will no longer be able to access it or process any payments, refunds, or disputes.

Stripe vs Other Platform Comparison

Stripe is not the only online payment processing platform. Besides that, there are trustworthy ones such as PayPal and Square. So which one will need your demand? Let’s find out.

Stripe vs Paypal

Both Stripe and Paypal are well-known platforms, but what are the points to compare? There are 4 points to help you tell these services apart.

Paypal

Both Stripe and PayPal charge 2.9% + $0.30 per transaction. However, for international payments, currency conversion, and chargebacks, the users have to pay higher fees. Stripe offers volume discounts and customized pricing for large businesses. Users could use the Stripe coupon code for a significant discount. Let’s explore!

[exclusive_coupon|limit=3]

Online businesses are ensured with Stripe and PayPal features of invoicing, recurring billing, subscriptions, coupons, and so on. Stripe has more advanced developer tools and integrations that make it easier for customization and flexibility. Paypal, on the other hand, has a larger and more popular user base and supports Venmo and cryptocurrencies, which is more than Stripe.

Paypal takes less time to set up as it does not require any coding or technical knowledge, and has a user-friendly interface and dashboard letting users manage their payments and account settings. In contrast, Stripe is more suitable for developers and businesses who want to create their own payment solutions using Stripe's APIs and SDKs.

In terms of customer support, Stripe and PayPal both offer online support resources. However, Stripe’s customers are supported 24/7 through phone, email, and chat support.

Stripe vs Square

Another rival of Stripe is Square. In the world of payment processing, these two keep competing, each with its own strengths and strategies. Let's dive into these key differentiating factors.

Square

For online payments, Stripe and Square have similar pricing of 2.9% + $0.30 per transaction. But for in-person payments, Square charges lower fees of 2.6% + $0.10 per transaction, while Stripe charges 2.7% + $0.05 per transaction. With the Square coupon code, customers can have offers on reducing the prices of services.

Meanwhile Square offers specialized software and point-of-sale hardware to support brick-and-mortar businesses’ needs, Stripe has more advanced developer tools and integrations that allow for more customization and flexibility.

Square is more user-friendly for its setup, interface and dashboard while Stripe requires knowledge of APIs and SDKs to make use of this platform.

Conclusion

In conclusion, harnessing the power of Stripe for global business expansion and enhanced performance is a strategic move in the modern landscape. By seamlessly integrating multiple currencies, payment methods, and secure transactions, Stripe empowers businesses to tap into international markets with ease.

From its user-friendly registration process and versatile features to the ability to customize payment solutions, it provides an edge for those seeking tailored solutions. When compared to the competitors, it is clear that by using Stripe, businesses can navigate the intricate world of global transactions, optimize their financial systems, and lay the foundation for sustained growth on an international scale.